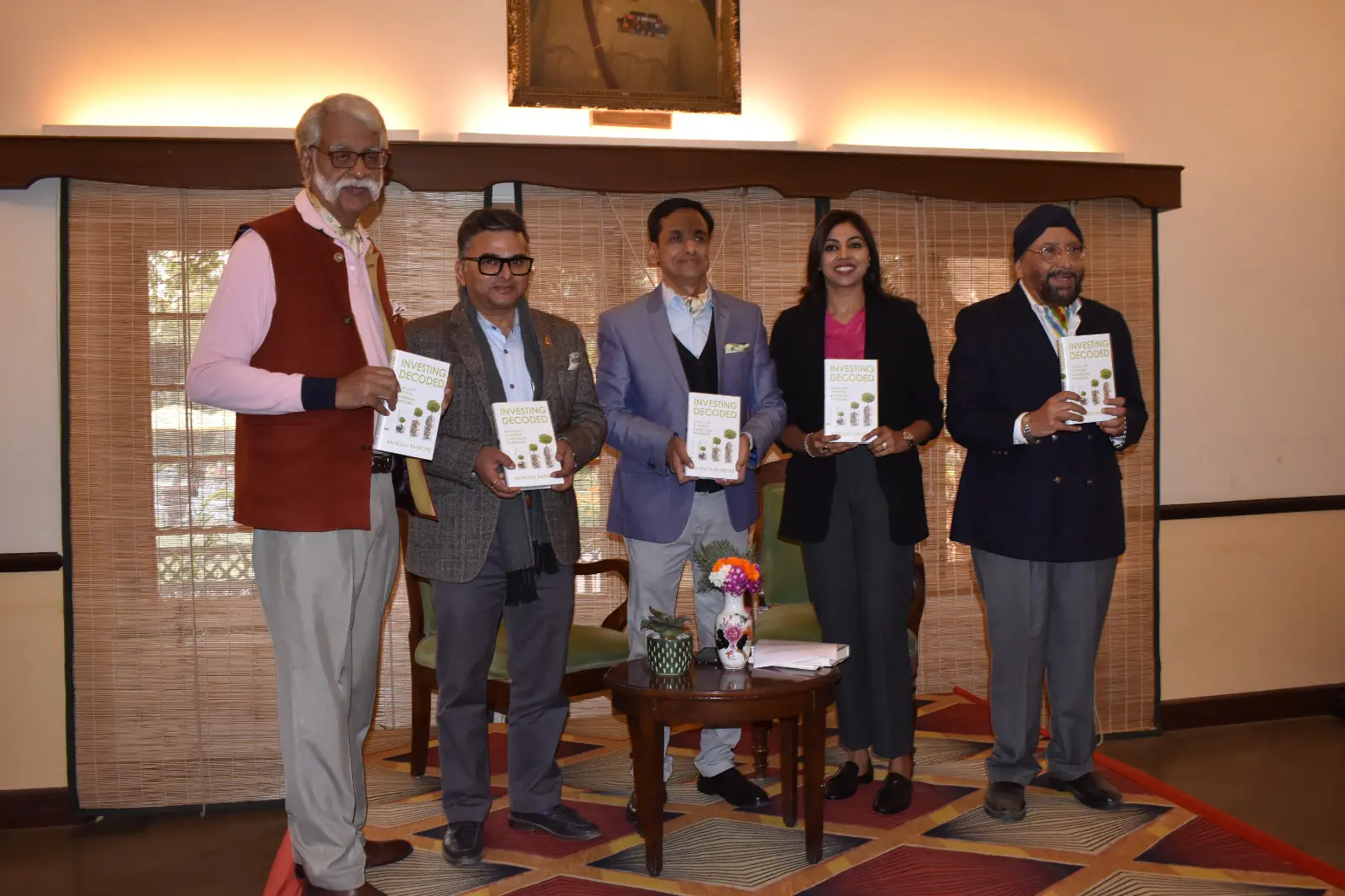

Jaipur : Investing is futuristic in nature and is all about predictions. Artificial Intelligence (AI) works on the principles of current and past information and cannot predict the algorithm of investing and trading. AI can help as a tool for automation of functions in investing, but it is no Nostradamus, which can predict future. This was stated by the former Investment Banker and Financial Advisor, Anirudh Rathore while talking about his book 'Investing Decoded: Simple Path to Building a Portfolio in Millions' at Ashok Club. He was in conversation with Educationist, Aakriti Periwal. The book session was organised by Mayo College Alumini Association (Jaipur Chapter) and Stephanians in Rajasthan (SIR). The Convener of SIR, Ajay Singha and President of Mayo Alumini, Jagdeep Singh were also present on the occasion.

Anirudh Rathore, who has over two decades of experience in equity investment, started writing his debut book during the Pandemic. He said that even though there is so much information available on investing, people are still not equipped with the basics and background. He said that with this book, he wanted to fill that gap so everyone could become a good investor.

Talking about the psychological aspects of being an investor, Anirudh said that besides financial acumen, one also needs to adapt to the psychological attitude. He said that people fear that if they invest, they will lose money, this is because they have deep rooted biases, especially conformation bias and preconceived notions. One needs to be aware of the biases to master investing.

He also discussed in detail about various mistakes or 'Investing Sins' people tend to make and about his own mistakes and experiments he did while he began investing.